Signed in as:

filler@godaddy.com

Signed in as:

filler@godaddy.com

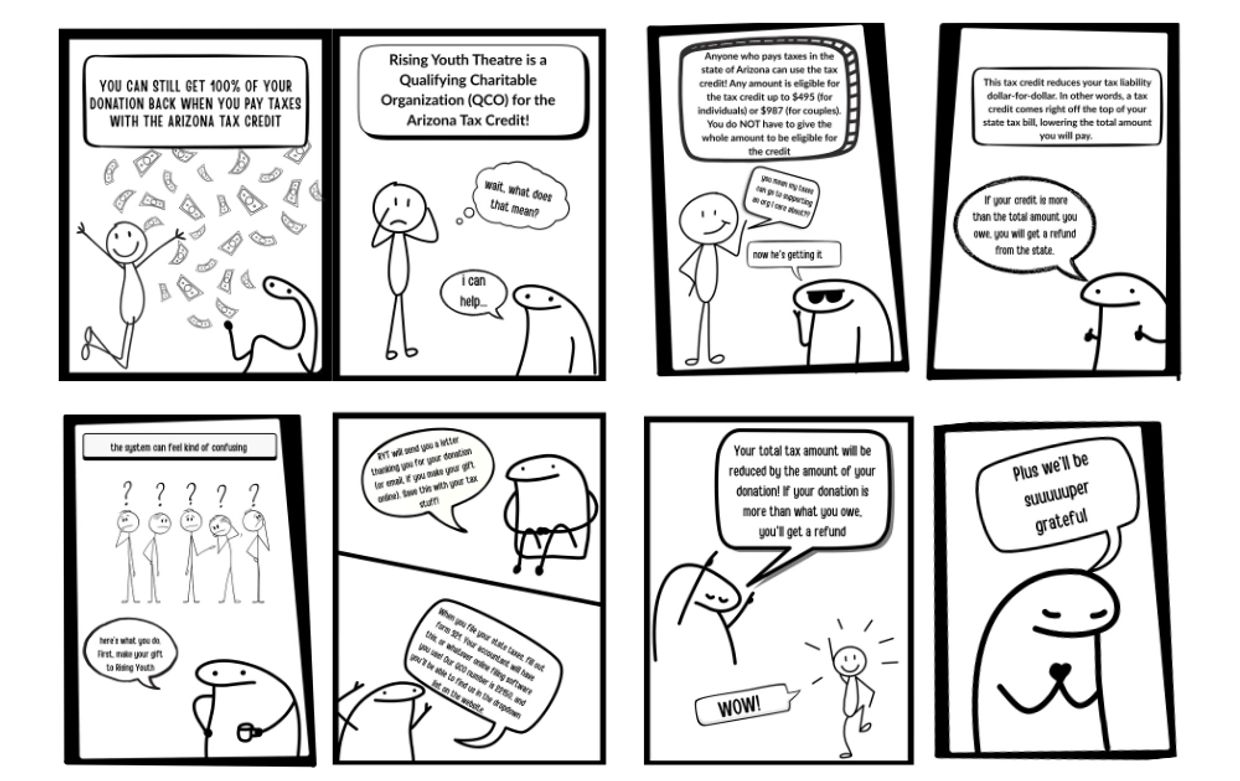

We are proud to share that Rising Youth Theatre is as a qualified charitable organization for the Qualifying Charitable Tax Credit (formerly the “Working Poor Tax Credit”)

With this status, you can replace your state taxes with a gift directly to Rising Youth Theatre! If you pay taxes in Arizona, you can redirect your tax dollars directly to Rising Youth, receiving your full donation (up to $470 for single filers or $938 for married filers) back as a dollar for dollar tax credit.

You can make a tax credit donation to Rising Youth Theatre through the Qualifying Charitable Tax Credit in addition to any tax credits you receive from contributions to Public or Private Schools and Qualifying Foster Care Organizations.

We are a small organization and your gift makes an immediate and transformative difference in our programs and work in the community. It allows us to pay our artists, including youth artists, provide meaningful programming both in and out of schools, and create a space for young people to be leaders.

Rising Youth Theatre

PO Box 34565 Phoenix, Arizona 85067

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.